SERVICE E EFFICIENCY E ACCOUNTABILITY

Dear Hall County Citizens,

We are proud of our many accomplishments, particularly in recent years navigating the challenges of an ever-changing world. Through innovation and adaptation, we have achieved our goals on an operating budget well below that of other counties of comparable size. To keep our momentum moving forward, we have set new goals for the fiscal years 2024 and 2025 to accommodate our county’s extraordinary growth and continue serving you effectively and efficiently.

Darla Eden Richard Steele

Tax Commissioner Chief Deputy Tax Commissioner

GOALS for 2024 – 2025

Ongoing initiative – We aim to identify and implement new ways to improve and provide the highest level of service to our residents, school system, county government, dealer and fleet partners and others, setting the standard as the leading Tax Office in the state.

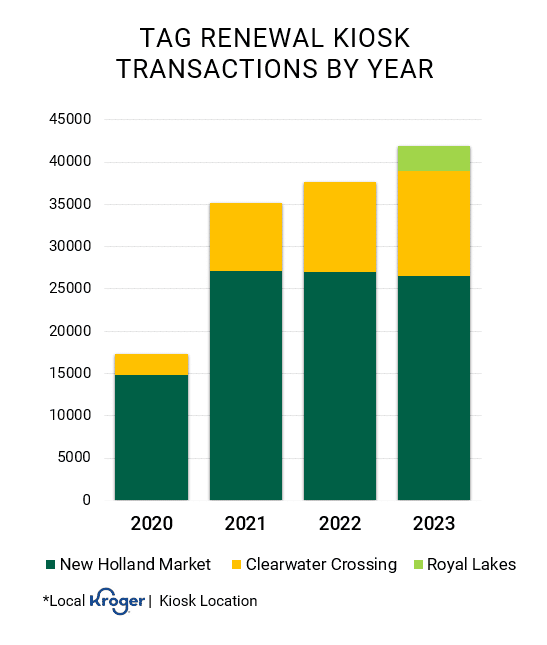

Self Service Tag Kiosks

- Approach the Board of Commissioners to request an allocation of funds to offset the $3.95 fee currently charged by the kiosk vendor.

- Open our fourth self-service tag renewal kiosk at Thompson Bridge Commons Kroger on Thompson Bridge Road, expanding our network and introducing the northernmost kiosk in the state of Georgia.

- Open our fifth self-service tag renewal kiosk in the lobby of the Hall County Government Center.

- Continue to increase the number of kiosk-based renewals per year through network expansion and an effective public information campaign.

Lobby Enhancements

- Modify/upgrade workstations, raising desks to eye-level with customers and making them more ergonomic. We also will focus on creating more privacy for conducting closed-record transactions and allowing the customer to view transaction details in progress.

- Continue to leverage technology to upgrade our lobby experience for customers, allowing them to view lobby wait times while we display important property tax and motor vehicle “how to” videos and updates.

Communications

-

- Research apps and software to aid our vision- and hearing-impaired residents.

- Continue appointment system with online capability in addition to text or phone.

- Utilize website traffic and search data to better understand the technology needs of our customers.

Customer Service & Access

- Expand texting service to nights and weekends so residents can receive a reply text after regular business hours.

- Initiate discussions with the Board of Commissioners about opening a South Hall branch office equipped with drive-through service for simple transactions such as renewals. A drive-through lane would greatly benefit physically handicapped residents and add more convenience for all residents.

- Expand use of our customer feedback system to facilitate continuous service improvement.

Interdepartmental Communication

- Adopt property tax software that facilitates greater communication with our partner departments such as tax assessors, finance, and administration.

- A full-time Homestead Auditor will study properties receiving homestead exemptions to ensure exempted parties continue to qualify for this specific exemption, and we will communicate these findings to the Board of Assessors. This will enable our department to increase collection efficiency and ensure everyone is paying their fair share.

Website

- Website traffic is steadily increasing for daily business that would traditionally bring people to the office. A continued effort in analytics will be used to make improvements that include new technology and services to benefit citizens.

- Promote use of our website’s online tools such as appointment scheduler, online bill-pay, our interactive virtual employee “Sidney,” and other e-services.

Education and Awareness

- Develop a variety of avenues to answer questions and disseminate relevant information in our community such as “how to” videos, materials, and online resources.

- Help educate our residents about available property tax exemptions such as homestead, senior, disability, and military classifications.

- Provide general education on property tax and motor vehicle terms, practices, and processes.

Cost-Effectiveness

- Maintain budget efficiency and internal excellence in stewardship of public funds.

- Maintain our decade-long 99 percent efficiency rate in property tax collections. This commitment ensures reliable and timely funding for essential Hall County services and that all property owners contribute their fair share to our community.

Property Tax Software Upgrade

- As we constantly look for ways to improve our back-office software and ancillary products, our top considerations are saving valuable staff time, seamless use between partner departments, and enhancing the taxpayer experience. As our county flourishes, we will seek a property tax system that adapts and grows with us.

Community Service and Outreach

We strive to do more community service and outreach. Relaying relevant information from our office to nonprofits, real-estate agents, attorneys at law, auto dealerships, and service industries, such as couriers and taxis, will make our office more efficient and resourceful.

Safety & Handicap Access

This office continues to provide the best possible service in the safest and most accessible manner possible. Making improvements in these areas will always be a goal for our office. Click Here to read an article on Darla Eden’s request for additional security at the Government Center from August 2022.